Car Insurance Difference in Pay Between 10000 and 20000 Miles

Feefo Platinum Trusted Service Award Cover for all named drivers on your policy No Mileage restrictions during life of policy

Our Gap Insurance Services

Finance/Contract Hire

Pays the difference between the motor insurers settlement and the outstanding Finance Balance. Suitable for HP, PCP, Lease and Contract Hire Vehicles.

Find out more >

Return to Invoice +

Pays the difference between the motor insurers settlement and either the invoice price or the amount outstanding on finance whichever is the highest.

Find out more >

Vehicle Replacement +

Pays the difference between the motor insurers settlement and the cost of a replacement vehicle matching the original specification, age, mileage or the amount outstanding on finance whichever is highest.

Find out more >

See what our customers are saying about us

Gareth Thomas 5 Excellent gap insurance cover at a reasonable price. Why is it that it's not so widely known by the general car buying public?

DEREK BELL 5 Quickly done just several days to decide who with.

Amie Wilson 5 Good

Sarah Boardman 5 Giving 5/5 assuming the policy does what it says it will if I need to use it at all. Great price, easy website to use and seemed really clear. Thanks Sarah

keith woodman 5 very easy to use website clear wording quick service thanks

kirsteen reekie 5 Very easy to set up and purchase. good explanations of the differences in the policies available

John Lovelace 5 Very simple process to take out the insurance plus it was a very competitive price.

Steve Shardlow 5 Super easy and very competitive pricing. If I ever need to claim, I hope it's just as easy as taking out the policy!!!

Matt de Hoest 5 Very good so far - very easy to arrange. Hopefully the cover is as good as claimed.

ozlem akkuyu 5 nice and easy website

Daniel Coleman 5 Easy smooth transaction and better value than the dealers. So glad I chose you guys and didn't fall into the dealer trap. Lets just hope I never have to use the Insurance.

Michelle Gaunt 5 cheap prices easy set up

Penelope Bell 5 Very smooth process, and good value. As I always tell my friends to get GAP Insurance, I better take it out in my own new car!

Andrew Syrett 5 Easy to understand level and extent of cover

Nicola Goakes 5 Clear and speedy service

Hayley Seymour 5 Easy to use, good examples

Mike Hill 5 Second policy for me keep it up..

paul tracey 5 Elizabeth phoned who was very nice and genuinely explained why the return to invoice was best. I was happy with the finance only option but didn't take into account the fact I have put money down etc.

andrew scott 5 seemed easy enough to select and pay liked being able to use paypal

Kevin Bentley 5 Called the helpline to get advice on which product to buy and what value to add to the quote. Staff were really knowledgeable and very friendly and helpful

Chris Tyerman 5 Easy, comprehensive and good coverage

Kyle Read 5 Very affordable compare to other companies out there and used these on my other vehicle

Jonathan Drew 5 Considerably cheaper than the quotation from the dealer.

Mark Dillon 5 Good price, included excess cover at no extra cost.

Gap Insurance Policy Benefits

"5" Star Rated Insurance with a 30 day money back guarantee

No Claim Limits on vehicles up to £50k

Free policy transfer on RTI and VRI

Deferred start date option for new vehicle purchases

Cover for ALL named drivers on your policy

No mileage restrictions during life of policy

Policy amendments for registration number & address changes

Commitment to settle your claim within 10 days

Credit card payments, no additional fees

Save up to 75% with a specialist policy

Find Out More

Monthly Payments Available

Call our payments team to find out more on

01422 756 100

Mon-Fri 9am-6pm, Sat 10am-4pm

What is Gap Insurance

Gap Insurance covers the difference between your insurance offer at the point your car is written off or declared a total loss and the value of your car when you bought it. It will also cover any outstanding finance payments, plus – for some enhanced policies – any additional costs needed to get you back on the road with a car to the same specification as when it was purchased. Taking out Gap Insurance is important because cars depreciate over time and your motor insurer will value it in line with depreciation. If your car is written off, your motor insurance policy only covers your vehicle to its value at the point it is declared a total loss. This can be substantially less than outstanding finance commitments, the price you paid for your car and the cost of getting back on the road in a car with a similar specification.

Get a Quote

How does Gap Insurance work?

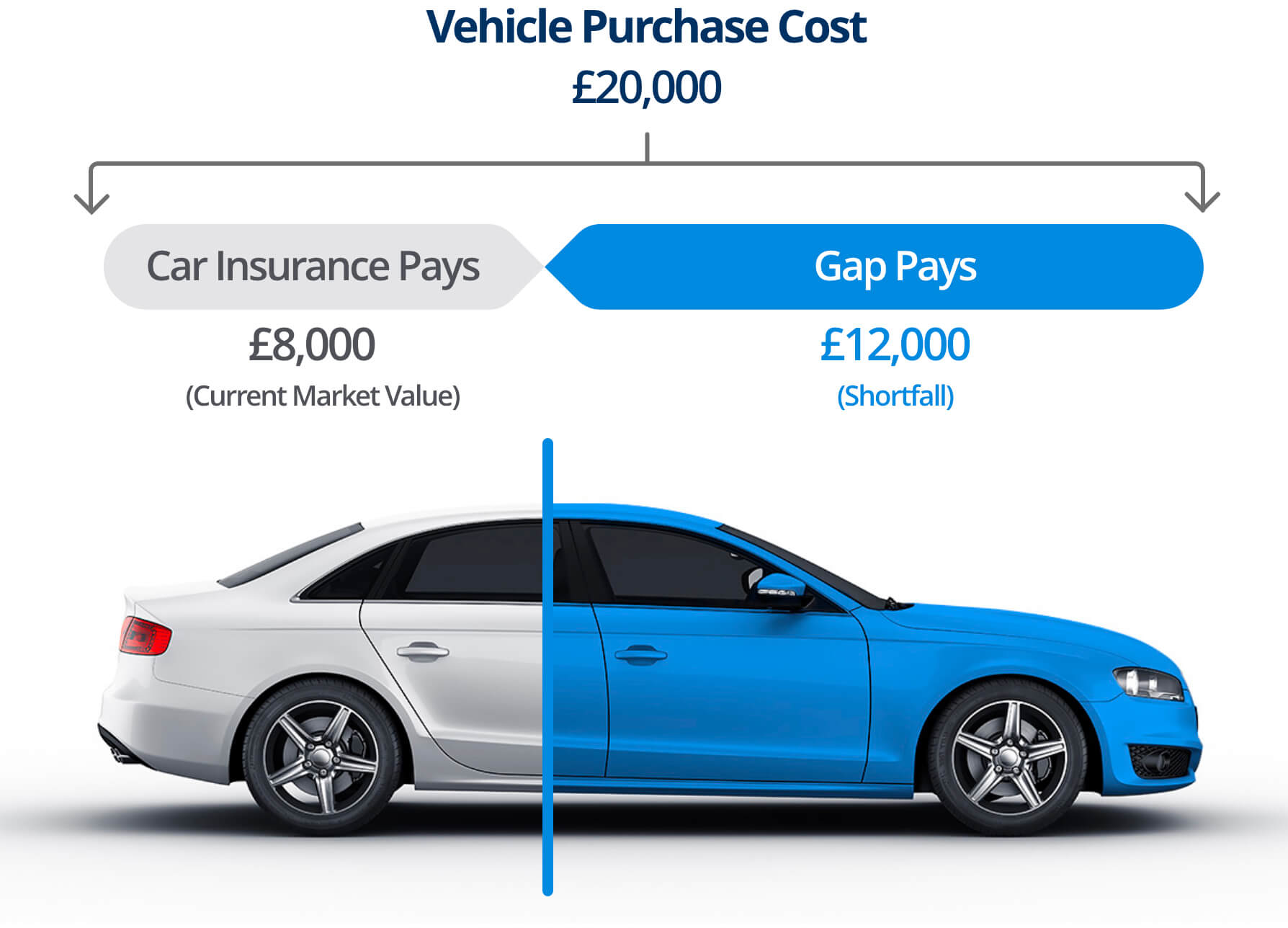

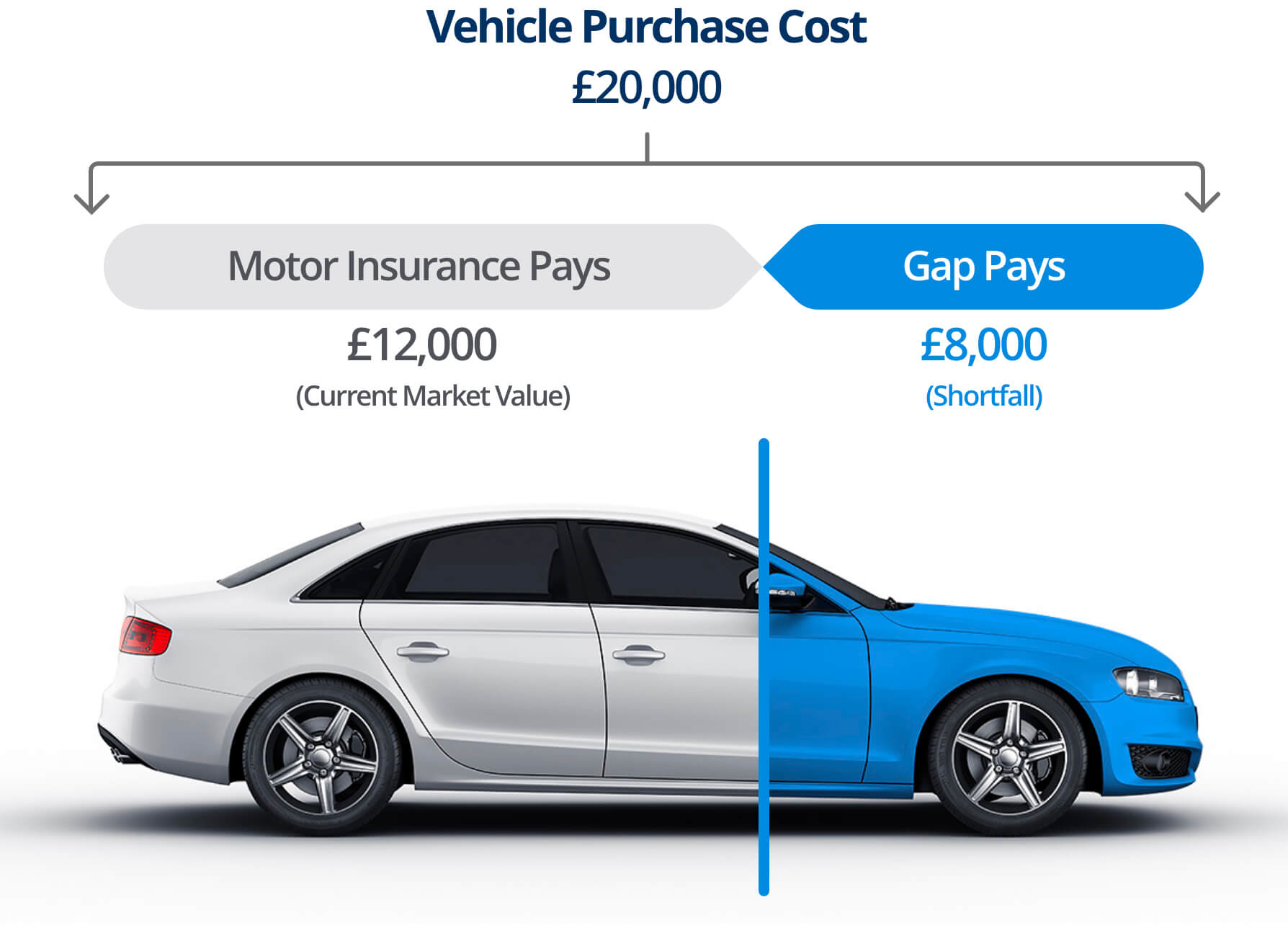

For example, let's assume you purchased a car for £20,000 and it was worth £8,000 at the time it was written off or stolen. Your Gap Insurance would cover the shortfall of £12,000, meaning you won't be left significantly out of pocket. If you paid for the vehicle via a finance agreement, your Gap Insurance policy would cover the outstanding amount. That means you're not left repaying the finance company for a car that you can no longer use.

Get a Quote

We also offer additional insurance for the following:

Tyre Insurance

Covers the cost of the replacement or repair of the tyres fitted to your vehicle that have sustained either accidental or malicious damage.

Find out more >

Scratch & Dent Insurance

Scratch & Dent Insurance covers the cost of parts and labour to repair your vehicle in the event of minor accidental damage to the bodywork.

Find out more >

Alloy Wheel Insurance

Alloy Wheel Insurance covers the cost of repairing accidental damage which has occurred to your Alloy Wheels.

Find out more >

Should I buy Gap Insurance?

Gap Insurance may not be suitable for everyone, but it could be more than worthwhile if:

- The car you bought is due to depreciate quickly. If you were to suffer a total loss, its value may be dramatically reduced from the point of purchase, meaning your motor insurer's pay-out would leave you with a significant cash shortfall and you'd be unable to replace the vehicle on a new-for-old basis.

- You're on a long-term contract hire. If you're paying back your debt slowly, the payment you receive from your motor insurer following a total loss may not be enough to cover the amount you owe to the hire company.

- You owe a balloon payment. Sometimes, the details of your finance deal might mean you are left with a large lump sum to pay to the hire company at the end of the agreement. This is known as a balloon payment and taking out a Gap Insurance policy can help you to cover this without falling into financial difficulty.

Get a Quote

When wouldn't I need Gap Insurance?

Not everyone will need Gap Insurance, however. For example, it may not be required if:

- Your car is brand new. Many motor insurers offer a replacement of your vehicle within the first 12 months of ownership. Even in that instance, it may still be worth considering taking out a Gap Insurance policy and deferring the start date by 12 months. However, it is worth noting that your policy must still be bought within 180 days of you purchasing the car, even if you are deferring.

- You've put down a large deposit. If you've been able to come up with a sizeable down payment for your vehicle, you will minimise the possibility of being left with a large shortfall on the finance agreement and there may be no need to take out a Gap Insurance policy.

- You can afford to make up the difference. If you're fortunate enough to be able to cover the difference between the cost price and the value of the car, Gap Insurance may not be necessary for you.

What are the different types of Gap Insurance?

Here at Direct Gap, we pride ourselves on our ability to offer a tailored Gap Insurance policy that's perfectly suited to you and your needs. To that end, we offer a range of different products designed to meet your specific requirements:

- Finance/Contract Hire: If your vehicle is declared a total loss, this type of Gap Insurance will pay the balance between your motor insurer's settlement and the amount you have left to pay on your finance agreement. It includes all drivers on your policy, you can be covered for one to five years and it also provides protection of any factory fitted options you may have added to the vehicle.

- Return to Invoice +: Should your car be written off in an accident or stolen, our Return to Invoice + policy will pay the difference between the settlement you receive from your motor insurer and the amount you paid for the car in the first place. This policy is applicable to both new and used cars, is transferrable free-of-charge and we also offer a 30-day money back guarantee.

- Vehicle Replacement +: With this policy, our pay-out will cover the difference between your insurer's settlement at the point of total loss and the cost of a replacement vehicle matching the cars original specifications. Our Vehicle Replacement + policy will cover any dealers discounts as well as any increase in the cars list price.

- Agreed Value: Should your car be declared a total loss, our Agreed Value Gap Insurance will pay the difference between your motor insurer's settlement and 100% of the Glass's Guide retail price at the time you bought the policy. Our Agreed Value insurance provides cover for one to four years, is transferrable for free and protects you if your vehicle is lost through the theft of your keys.

How much is Gap Insurance?

There is no set fee for Gap Insurance, as your quote will vary depending on the original price of your car and the length of policy you wish to take out. For example, a five-year policy on a car costing £20,000 will come at a higher premium than a one-year policy for a £10,000 car. What we can guarantee at Direct Gap is that your policy will come at a highly competitive price and the service you'll receive from our expert and friendly team will be second to none.

Get a Quote

Are there any exclusions?

There are some circumstances in which your Gap Insurance would not cover you, or in which you would be unable to take out the policy in the first place. These include:

- Driving under the influence: If the total loss of your car is caused by the driver of your vehicle being under the influence of drugs, alcohol or prescribed medication (where the person in question has been advised against getting behind the wheel by a medical professional), your Gap Insurance policy will be void.

- Negligence: If your car is stolen due to negligence on your part, for example if you leave the keys in the vehicle, your Gap Insurance will not cover you.

- Hire and reward schemes: If you are a taxi driver, haulier or courier, for example, our Gap Insurance products will not be applicable to you.

- Vehicle age and mileage: Any car over 10 years old or with more than 100,000 miles on the clock at the time of purchase will not qualify for Gap Insurance.

Why choose Direct Gap as your Gap Insurance provider?

So, you've purchased your new car and you're seeking a robust Gap Insurance policy at a reasonable cost. Here are just some of the many reasons why Direct Gap is perfect for you:

- Service: Our customers are extremely important to us and we're really proud of the feedback we get. But don't just take our word for it – our glowing testimonials and Feefo 5-star rating speak for themselves.

- Knowledge: We don't run a call centre. We are a professional team of qualified specialists who know about cars, Gap Insurance and motor finance. If you ever have to make a claim, it will be handled by the same trained experts quickly and efficiently.

- Flexibility: We want to ensure you pick a policy that's right for you, and our team will do everything they can to provide the cover that's perfect for both you and your vehicle.

- Responsibility: We're fully regulated by the Financial Conduct Authority, so you can rest assured you're dealing with a fully reputable provider of Gap Insurance.

- Integrity: Our team receive no commission from sales so you can be sure they're acting with your best interests in mind.

Get a Quote

Get your Gap Insurance today

You want to be able to take to the road with complete confidence, and a Gap Insurance policy from Direct Gap can offer that all-important peace of mind. You can get a quote in a matter of moments via our simple form and if you have any questions please don't hesitate to give us a call on 01422 756 100. Our friendly, expert team will be more than happy to help you find the perfect cover for your pride and joy.

Get a Quote

Need help? Read our useful guides:

Car Insurance Difference in Pay Between 10000 and 20000 Miles

Source: https://www.directgap.co.uk/